Airwallex Payment link

2021

Overview

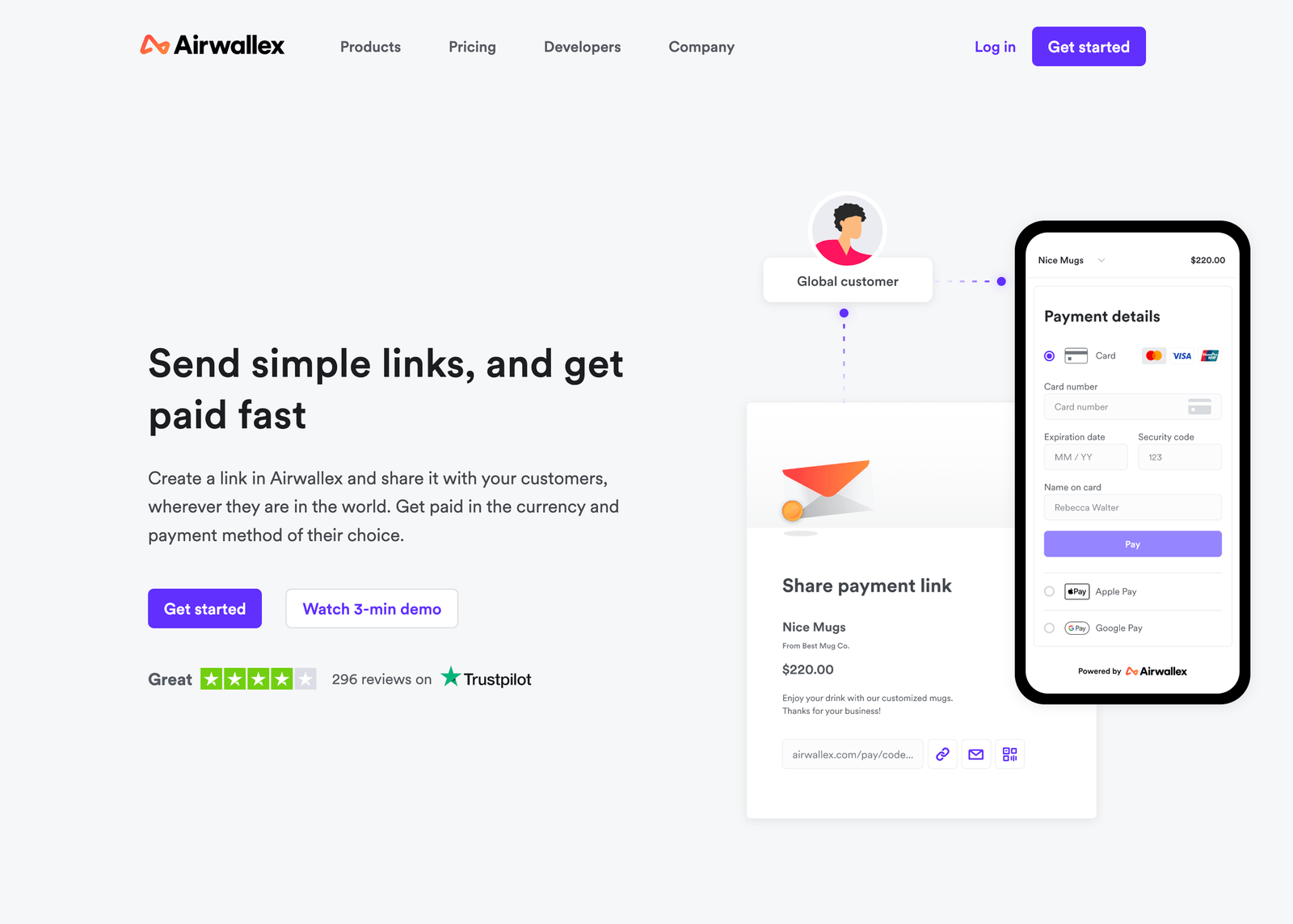

Airwallex is a fintech unicorn startup in the APAC region. As the Product Manager, I led the end-to-end development of Payment Link, a no-code tool that enables merchants to collect payments by simply sharing a URL. From initial problem discovery to product launch, I drove alignment across design, engineering, operations, and go-to-market teams to ship a product that now serves businesses across multiple markets and use cases.

Role

Product Manager

I was the Product Manager and launched the product from 0 to 1.

Impact

- In August 2021, Airwallex Payment Link was launched to all users in AU, EU, and selected users in HK.

- It had $160K transaction volume within 2 weeks of launch. Now the product has a transaction volume of X million per month.

- The team adopted the roadmap and 3 PMs are now executing the strategy.

The Opportunity

Airwallex’s core payments infrastructure was powerful but lacked a lightweight, no-code entry point for merchants who didn’t want to integrate APIs or embed payment buttons. We saw growing demand from education providers, event organizers, and SMBs who needed something simpler—especially in markets with low developer resourcing. The opportunity was clear:

Build a link-based payment tool that was fast to create, flexible to customize, and trusted by users from day one.

Understand the problem space

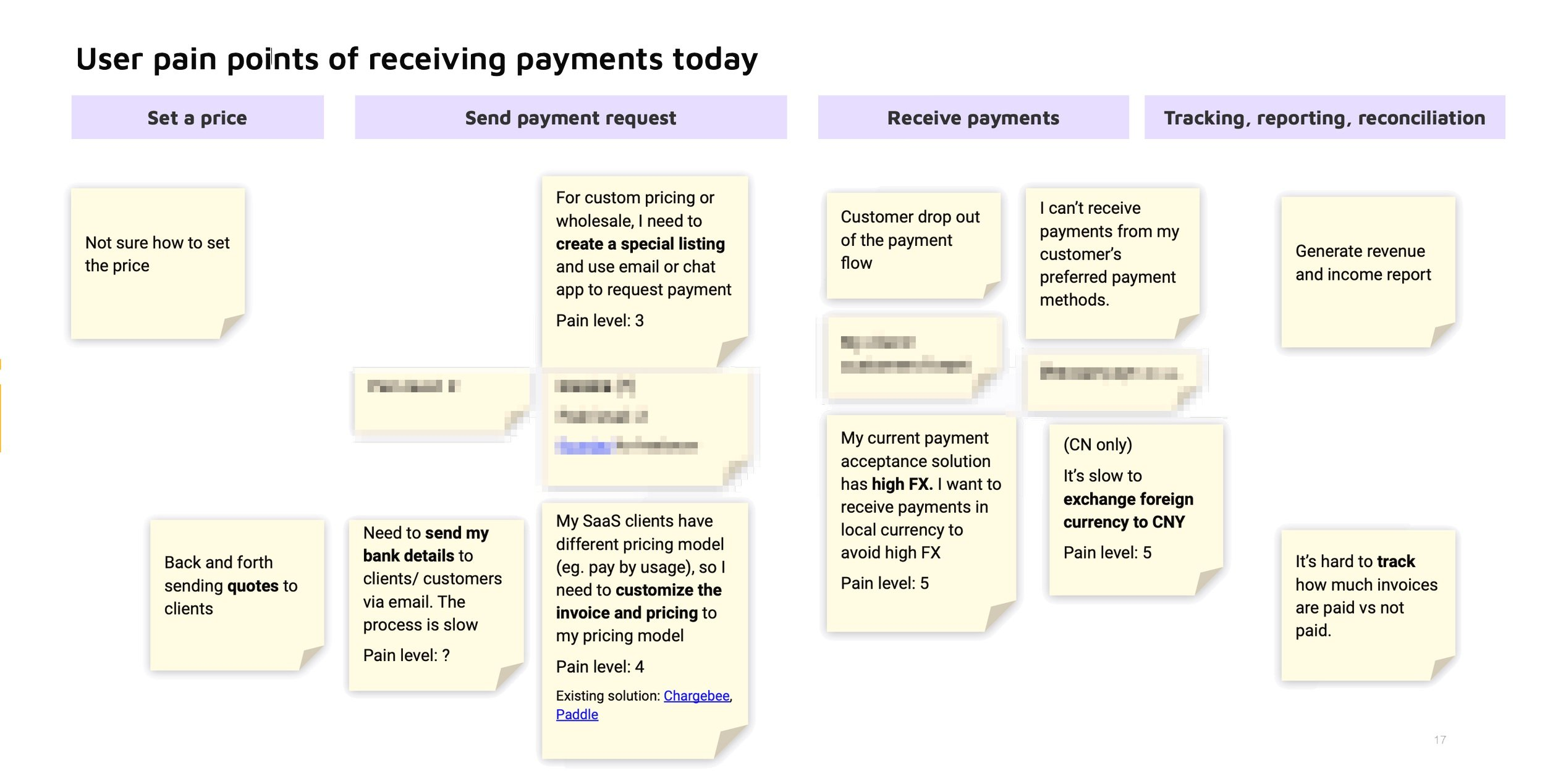

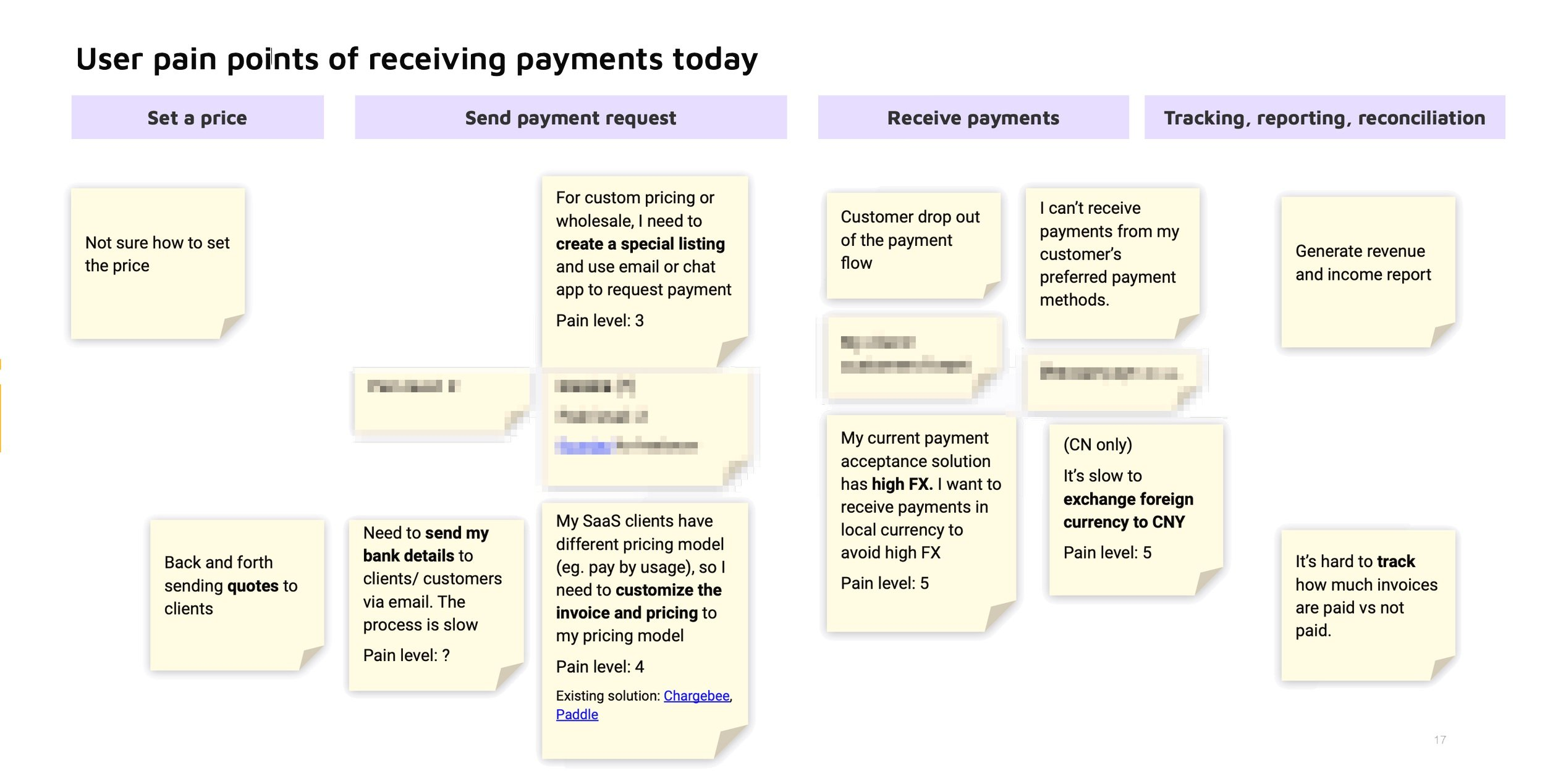

To shape the direction of Payment Link, I started by getting close to our users. The UX designer and I ran surveys and interviewed merchants across different markets. What we heard was consistent: price matters, but so does the ability to offer a range of payment methods, integrate with back-office tools like accounting software, and customize the customer-facing experience.

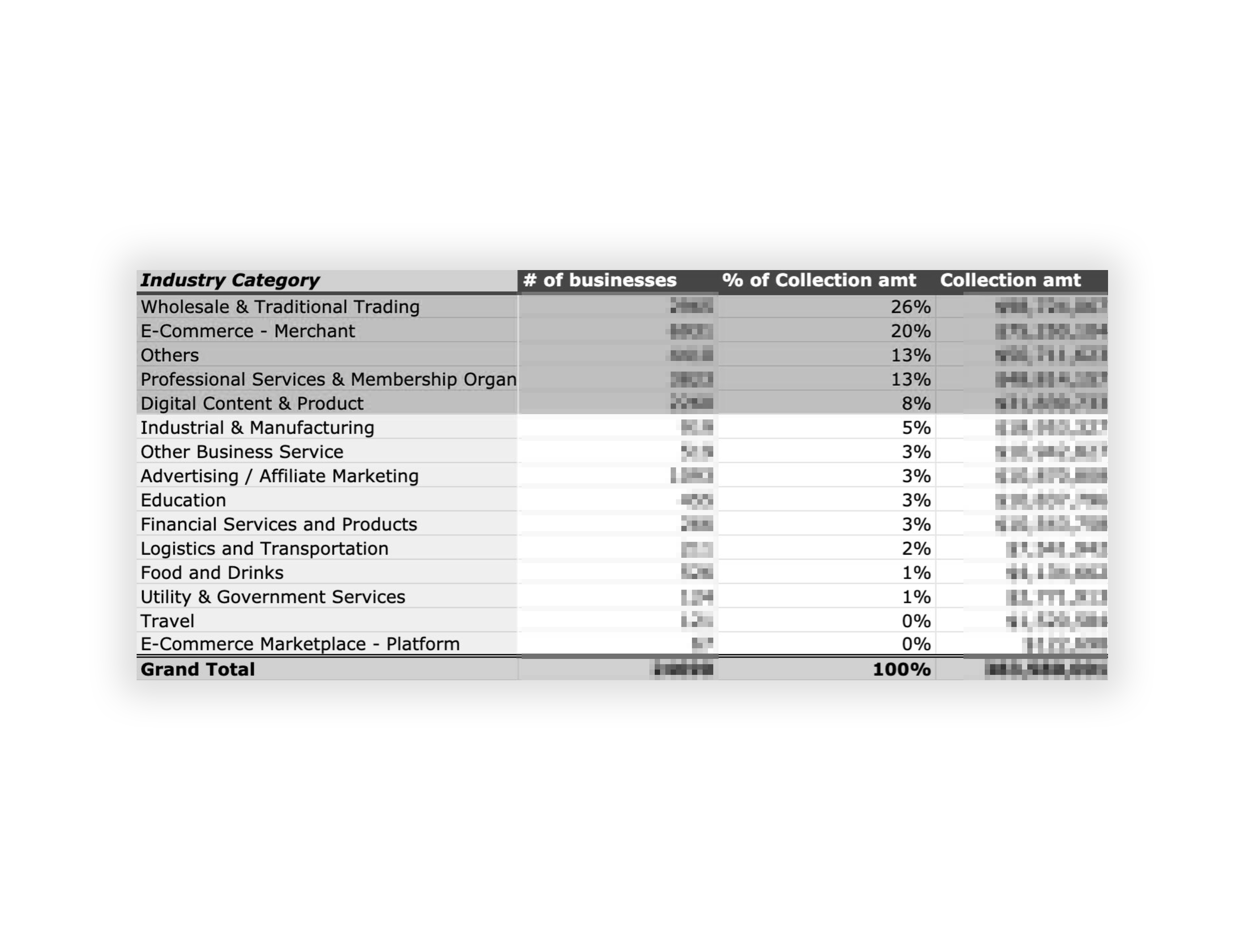

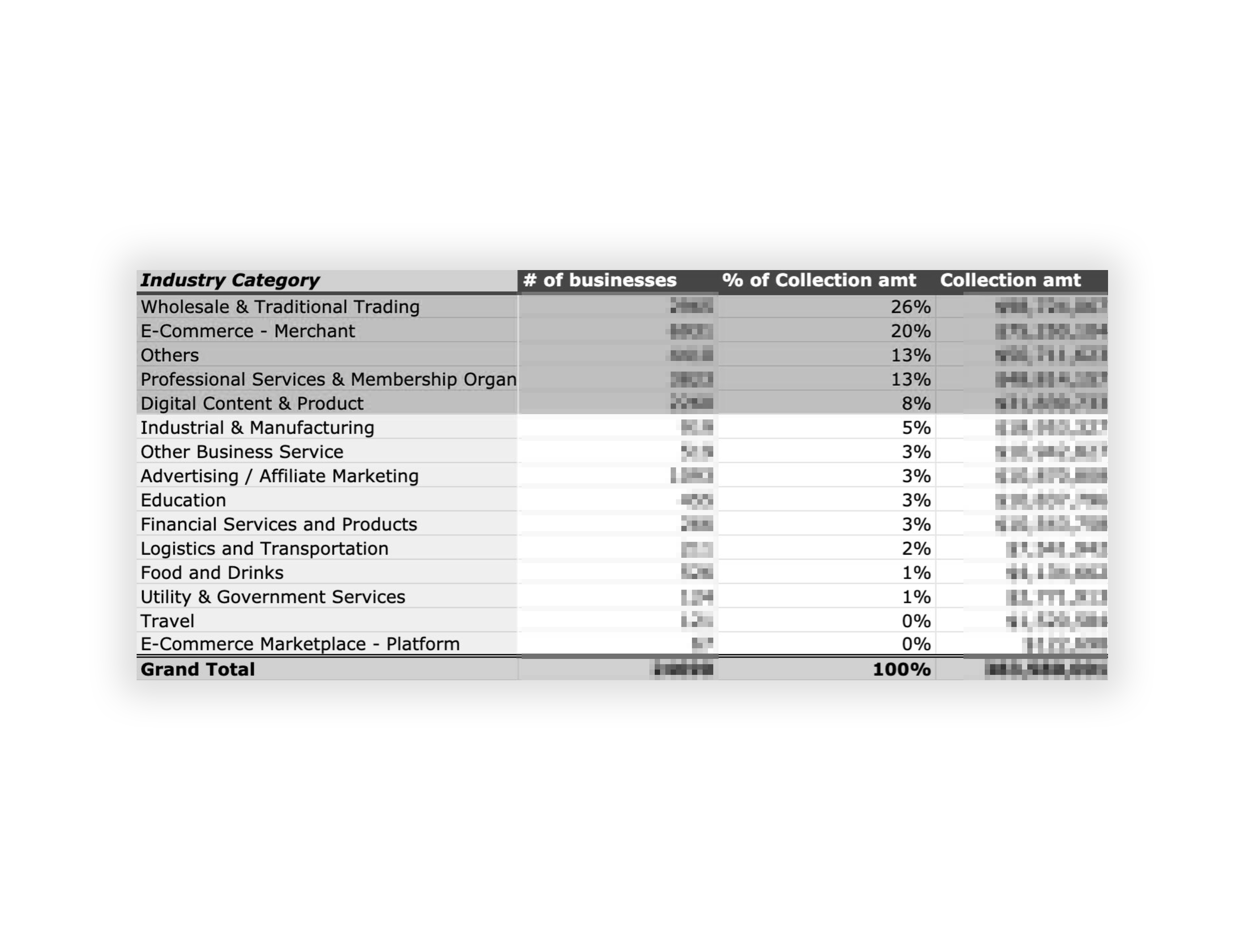

Most of our existing merchants were based in Hong Kong and China, but their needs were quite different—highly localized, with unique payment behaviors that didn’t align with our early capabilities. Instead, we saw a clearer product-market fit in Australia, especially among e-commerce and professional service businesses. That insight shaped our v1 launch focus.

Define product strategy

I also spoke with sales, marketing, and operations teams to understand the competitive landscape. Airwallex had a clear edge on cross-border pricing, but we were missing key payment methods like AMEX and Discover—especially critical in English-speaking markets.

🚀

Launch quickly to serve the cross-border use case we could win today

💳

Prioritize expanding payment methods to stay competitive as we scaled

Design

Based on the research, I redefined use cases and edge cases and worked with the designer to iterate on the UX with input from customers.

See design in Figma

Execution

To ensure a smooth rollout, I established lightweight processes for cross-functional reviews, decision-making, and launch readiness. Working across time zones, I kept engineering, design, ops, and GTM teams aligned through clear documentation and async coordination.

Impact

In August 2021, Get Paid was launched to all users in AU, EU and selected users in HK and had $160K transaction volume within 2 weeks of launch.

Airwallex Payment link

2021

Overview

Airwallex is a fintech unicorn startup in the APAC region. As the Product Manager, I led the end-to-end development of Payment Link, a no-code tool that enables merchants to collect payments by simply sharing a URL. From initial problem discovery to product launch, I drove alignment across design, engineering, operations, and go-to-market teams to ship a product that now serves businesses across multiple markets and use cases.

Role

Product Manager

I was the Product Manager and launched the product from 0 to 1.

Impact

- In August 2021, Airwallex Payment Link was launched to all users in AU, EU, and selected users in HK.

- It had $160K transaction volume within 2 weeks of launch. Now the product has a transaction volume of X million per month.

- The team adopted the roadmap and 3 PMs are now executing the strategy.

The Opportunity

Airwallex’s core payments infrastructure was powerful but lacked a lightweight, no-code entry point for merchants who didn’t want to integrate APIs or embed payment buttons. We saw growing demand from education providers, event organizers, and SMBs who needed something simpler—especially in markets with low developer resourcing. The opportunity was clear:

Build a link-based payment tool that was fast to create, flexible to customize, and trusted by users from day one.

Understand the problem space

To shape the direction of Payment Link, I started by getting close to our users. The UX designer and I ran surveys and interviewed merchants across different markets. What we heard was consistent: price matters, but so does the ability to offer a range of payment methods, integrate with back-office tools like accounting software, and customize the customer-facing experience.

Most of our existing merchants were based in Hong Kong and China, but their needs were quite different—highly localized, with unique payment behaviors that didn’t align with our early capabilities. Instead, we saw a clearer product-market fit in Australia, especially among e-commerce and professional service businesses. That insight shaped our v1 launch focus.

Define product strategy

I also spoke with sales, marketing, and operations teams to understand the competitive landscape. Airwallex had a clear edge on cross-border pricing, but we were missing key payment methods like AMEX and Discover—especially critical in English-speaking markets.

🚀

Launch quickly to serve the cross-border use case we could win today

💳

Prioritize expanding payment methods to stay competitive as we scaled

Design

Based on the research, I redefined use cases and edge cases and worked with the designer to iterate on the UX with input from customers.

Execution

To ensure a smooth rollout, I established lightweight processes for cross-functional reviews, decision-making, and launch readiness. Working across time zones, I kept engineering, design, ops, and GTM teams aligned through clear documentation and async coordination.

Impact

In August 2021, Get Paid was launched to all users in AU, EU and selected users in HK and had $160K transaction volume within 2 weeks of launch.